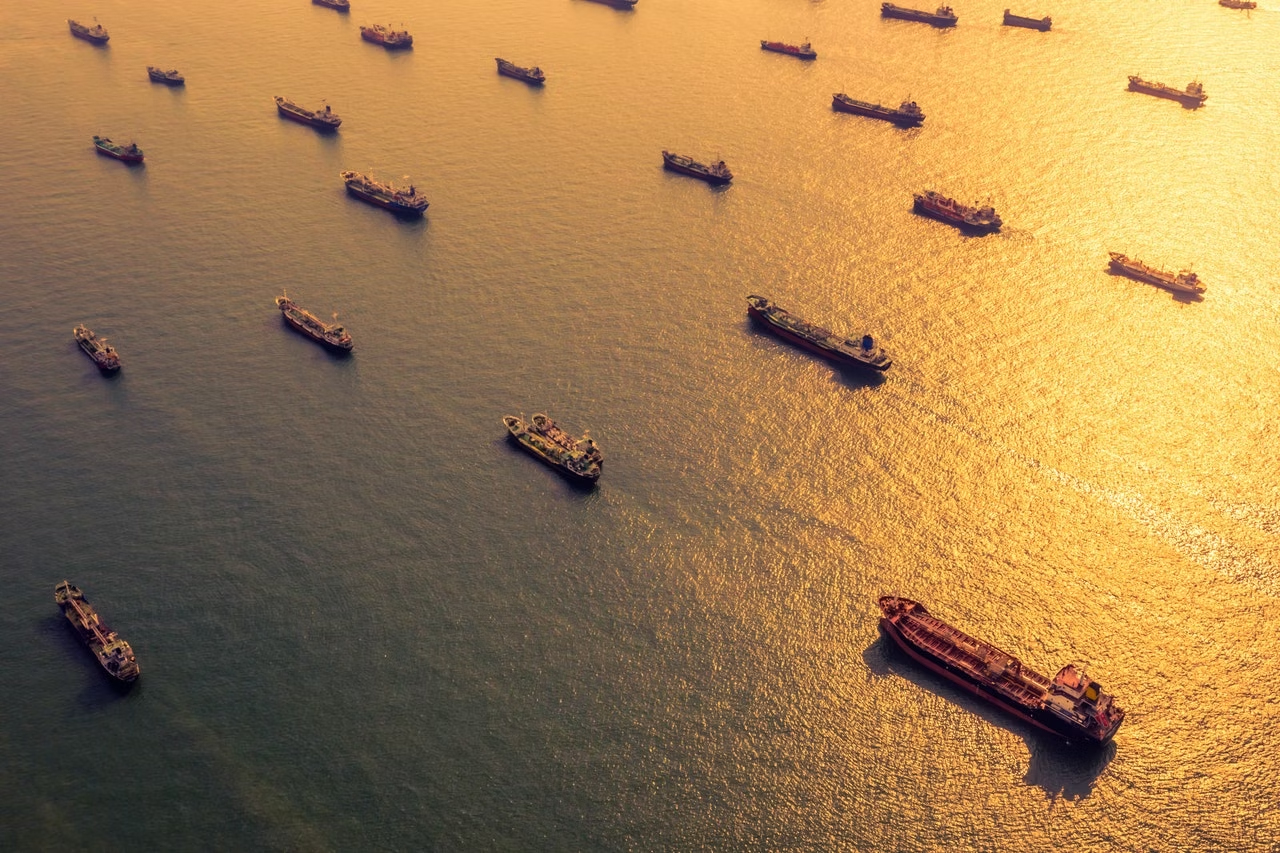

In February and early March, benchmark crude oil prices experienced a notable decline driven by increasing concerns regarding the global economic outlook and the anticipated growth in oil demand. These worries were exacerbated by escalating trade tensions, particularly between the United States and other key economies, which heightened uncertainty in the market.

Additionally, OPEC+ announced plans to gradually unwind production cuts starting in April, further contributing to downward pressure on prices. At the time of writing, ICE Brent futures had declined by $11 per barrel over the preceding eight weeks, approaching three-year lows and hovering around $70 per barrel.

The macroeconomic landscape influencing oil demand projections has deteriorated significantly over the past month. The introduction of new tariffs by the United States, coupled with retaliatory measures from affected countries, has skewed macroeconomic risks towards a more negative outlook.

The latest data on oil demand has fallen short of expectations, prompting revisions to growth estimates for key regions, specifically 4Q24 and 1Q25, which have been slightly downgraded to approximately 1.2 million barrels per day. This adjustment reflects underwhelming demand data from both advanced and developing markets, which have consistently come in lower than previous projections.

Despite these challenges, global oil demand growth is still projected to average just over 1 million barrels per day for the year, a significant increase from the 830,000 barrels per day anticipated for 2024. This expected growth is partially attributed to the recent decline in oil prices, which tends to stimulate demand. Notably, Asian countries are anticipated to account for nearly 60% of the projected gains in demand, with China at the forefront of this growth.

In China, the demand boost is expected to come primarily from petrochemical feedstocks, while demand for refined fuels is anticipated to stabilize as it reaches a plateau. This intricate interplay of factors underscores the ongoing fluctuations and complexities within the global oil market.